The US Dollar – An Insight – Bigger Picture

The US Dollar – An Insight – Bigger Picture

The Dollar – Versus the Euro

It’s a 6 minute read –

Understanding our clients exposure to EUR/USD annually, we have put together the below research piece for your interest. Below we outline how we see EUR/USD trading over the course of 2023 – giving our clients our 3, 6 and 9 month EUR/USD trading forecasts. This will hopefully be helpful over the next few weeks/months as you hedge your EUR/USD exposure.

This is intended to give you a good overview, macro picture – we can obviously help you on a more micro level when you actually need to hedge.

With this as our backdrop we will take a look at the following;

1. Firstly, we will examine how the Dollar has traded over the previous 12 months.

2. We will then look at the principle drivers of this Dollar trend over the course of the past 12 months and more importantly what we feel will be the pertinent drivers going forward for EUR/USD over the next 9 months.

3. Finally we will examine where we see the highest probability of EUR/USD trading on a 3, 6 and 9 month time horizon – bringing us up to year end.

The Dollar’s Performance over the past 12 months

Let us take a bird’s eye view of the recent Dollar trend, dating back to the beginning of 2022. Below is a chart of the DXY Index – the DXY Index represents the strength of the Dollar at any one time versus a basket of major global currencies. EUR/USD makes up over 50% of this basket. As we can see from the chart below – the Dollar Index (DXY) rallied over 21% over the course of 2022 to its peak towards the end of Sept 2022– this was known as the Dollar’s ‘’exceptionalism’’ phase in the financial markets. We have subsequently seen a 12% decline in the Dollar from its peak in Sept, down to its lows at the beginning of Feb this year.

Chart – DXY – The Dollar Index’s performance from 2022 – to present. Volatility is certainly back in the currency markets and a robust hedging strategy is paying dividends.

Chart – EUR/USD – Euro’s performance from 2022 – to present. As the US Dollar rallied during this period, the EUR/USD traded lower. As we can see in the chart below we broke parity in EUR/USD (1.00) in Aug 2022, trading to a low of 0.95 in late Sept – which equated to multi decade lows in EUR/USD – levels not seen since 2002 in the currency pair – truly a one off hedging opportunity. We have subsequently rallied over 15% off those lows seen in Sept to the highs just above 1.10 at the beginning of Feb 2023.

So why did the Dollar rally?

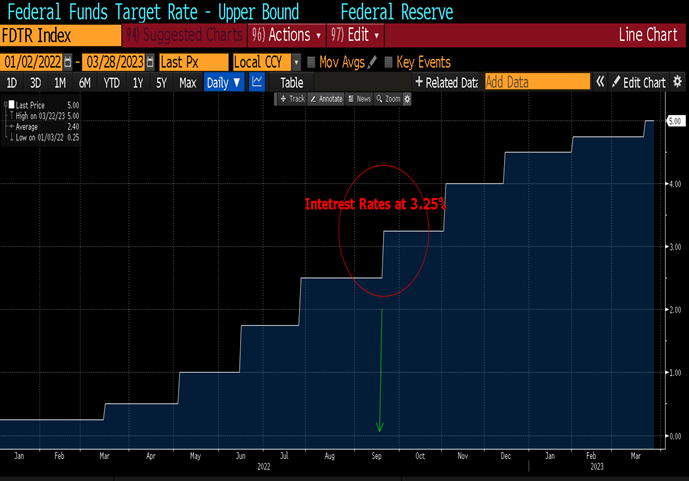

We mentioned above that this period was known as Dollar ‘’exceptionalism’’ in the currency markets, during and up to Sept 2022. The driver of Dollar strength largely stemmed from the actions of the Federal Reserve (Fed). The Fed was one of the first G10 central banks that embarked on an aggressive interest rate hiking cycle to curb runaway inflation in the US. Interest rate differentials are one of the major drivers of currency strength – so hence the higher the interest rates in a G10 country, usually the stronger the currency – this yield play attracts buyers of the higher yielder. The Fed aggressively hiked interest rates during this period from 0.25% to 5.00% – see chart below

Chart – the below chart demonstrates the consistent and aggressive month on month increase of interest rates in the US from Jan 2022 to present – where interest rates moved from 0.25% to 5%.

So, if interest rate were only at 3.25% in the US in Sept 2022, why did the Dollar top out back then and begin to weaken?

Well there were a number of factors beginning to play out back in Sept 2022. Firstly other global central banks had begun their interest rate hiking cycle. The US Dollar had rallied a long way – it was trading at multi decade highs. Inflation was also showing signs of slowing down in the US and the market felt the Fed would have to ease up on its hiking cycle soon, as the first whispers of recession in the US began to emerge. So the exceptionalist shine on the Dollar began to fade and the Euro began to recover versus the greenback.

The Euro recovered some 15% versus the Dollar up to the beginning of Feb this year, as the ECB begin its interest rate hiking cycle and recession fears hit the States. Feb’s economic releases out of the US however once again turned everything on its head – inflation stopped falling, the economic survey and sentiment indicators all turned positive and Feb’s employment report was a monster release.

Recession, what recession……! We pivoted from the Fed potentially cutting interest rates by year end, to interest rates now remaining higher for longer, with the financial markets pricing in fresh rate hikes. The macroeconomic picture completely flipped in Feb and remained positive until…… the SVB crisis and what could still turn into a full regional bank crisis in America.

It is incredibly unusual for these bigger picture macro views to flip flop within a matter of days, however these black swan events create such market volatility and turmoil– longer term views are forced to pivot.

Post the SVB crisis and subsequent Credit Suisse collapse we have quite quickly found ourselves back to Jan 2023 environment with regards to currencies – and that is the potential for a lower Dollar on the back of the Fed having to dramatically slow it’s interest rate hiking cycle – we currently have only one more 0.25% hike priced into the yield curve in the US, with a 0.25% cut in interest rates by the Fed priced in by year end.

Given how currencies have behaved throughout 2022 – we feel this will be the principle driver for the Dollar over the next 9 months.

So with US interest rates looking like they will top out next month in the US – leaving the terminal rate at 5.25%, a potential further escalation of the regional banking crisis – A member of the Federal Reserve Committee – Neel Kashkari –was quoted over the weekend – “Not all of these stresses are behind us. I expect this process will take some time…..Sometimes it takes longer for all the stresses to work their way out of the system … we know that there are other banks that have some exposure.” – We feel there is a higher probability is for a lower Dollar over the course of the next 3, 6 and 9 months.

Where to in 3, 6 and 9 months’ time?

3 Month Horizon – a break and weekly close above the yearly highs at 1.1033 is the first step that is needed. A break of this level should attract further buyers to the market and our target for the 3 month horizon for EUR/USD is 1.1200 – into the major pivot zone dating back to 2019, as shown on the chart below with the green line.

6 Month Horizon – The 1.1200 maybe a tough nut to crack however over the 6-month horizon we ultimately feel EUR/USD should rally through this resistance/pivot point and extend its move up to 1.1500 – where again we come up against major resistance – see chart below – red line represents further topside resistance.

9 Month Horizon – a clean break of the 1.15 level in EUR/USD should allow us to finish the year in the 1.1800-1.2000 zone. A slightly wider target here, however it is 9 months out.

Major risk events on the horizon

Major risk events on the horizon which may derail these forecasts – worth keeping on the radar.

1. Further contagion in the US from the SVB crisis to other regional banks

2. April’s employment figures out of the US – 7th April.

3. April’s Inflation figure out of the US – 12th April

4. Federal Reserve Interest Rate decision – 3rd May

5. ECB interest rate decision – 4th May

Treasury First is powered by Assure Hedge (UK) Limited, a company incorporated in England and Wales (No.10723112) with its registered office at 45 Eagle Street, London WC1R 4FS, UK, is authorised and regulated by the Financial Conduct Authority of the UK (FRN:783837). Assure Hedge Limited, the parent company, is incorporated in Ireland (No. 578153) with its registered office at Dogpatch Labs, CHQ Building, North Wall Quay, Dublin 1, Ireland.

This email and any files transmitted with it are confidential and intended solely for the use of the individual or entity to whom it is addressed. If you have received this email in error, immediately notify the sender by reply email and then permanently delete this email and your reply. Unauthorised use, disclosure, storage or copying of this email is not permitted. Whilst every endeavour is taken to ensure that emails are free from viruses, no liability can be accepted for any damage arising from using this email. Treasury First does not guarantee the accuracy or reliability of information in this message, and any views expressed are not necessarily the views of the company.