Daily FX Bites 21st July 2023

Welcome to our daily morning FX Bites email. A 30 second snap shot of the key economic releases and risk events that lie ahead from across the global. We have kept it concise and clear; however containing all the information you need to ensure you are up –to-date with the latest market moving events in the world of foreign exchange – from economic data releases to the latest central bank speakers.

What’s Going On?

Today’s Highlights – The Dollar continues its recovery this week lead by USD/JPY and GBP/USD. A weaker Inflation Report out of the UK earlier in the week was the catalyst for Sterling to sell off versus the Dollar and GBP/USD remains below the all-important 1.2950/1.30 level. This Dollar strength has fed into EUR/USD as well – trading off its highs seen last week above 1.1250 and currently trading down towards the 1.11 level.

We have just had the following comments from the Bank of Japan this morning –

-BOJ IS SAID TO SEE LITTLE NEED TO ACT ON YIELD CONTROL FOR NOW

-BOJ IS SAID STILL NOT CONFIDENT ABOUT HITTING PRICE GOAL STABLY

This takes any chance of a shift in monetary policy at next week’s Bank of Japan meeting off the table and has sent USD/JPY nearly 1% higher. This should add to further Dollar strength in the G10 space over the course of today’s session.

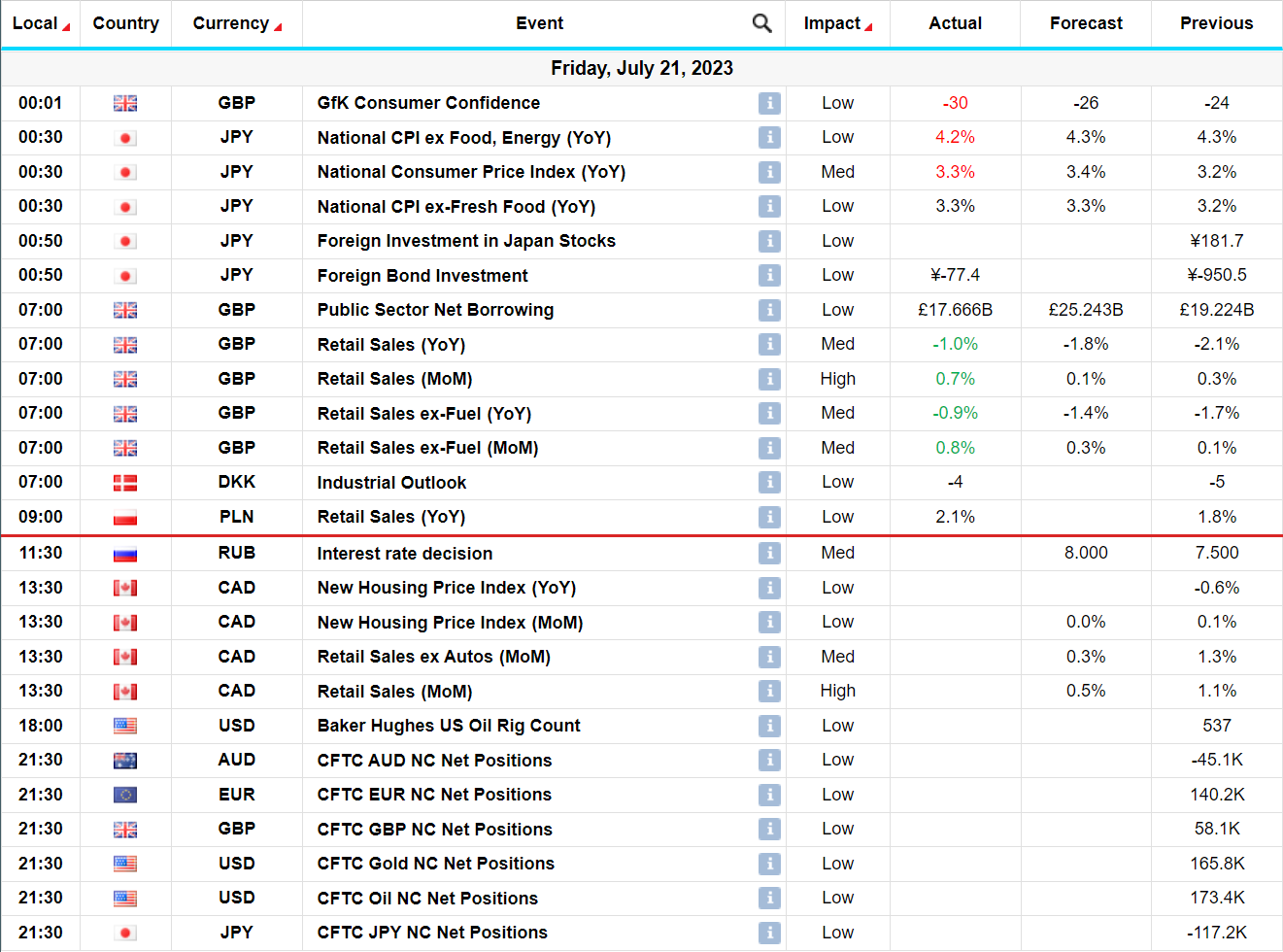

At ‘’ High’’ on the importance scale we had – Retail Sales out of the UK this morning at 7.00am. We had a better than expected print for retail sales across the board. That’s now 5/6 prints this year surprising to the upside. We initially saw Sterling strength, however the larger Dollar strength theme has subsequently taken over and the Pound has sold off versus the Dollar.

Chart of the Day – Initial Sterling strength on the back of stronger Retail Sales out of the UK this morning, however the larger Dollar theme has subsequently taken off.